A financial advisor writing on a doctor’s blog about mental health – surely something’s wrong here? Well, there’s a number of things wrong, “numbers” being one of them. Doctors tend to move in close circles, often making friends amongst colleagues. Yet, mental health is not really something you discuss around a braai. Therefore, few people have accurate estimates on the number of medical professionals that are diagnosed with mental health conditions. So, who can really give you an idea of what mental health statistics are within the medical profession? I’ll tell you who, the only party that legally forces you to disclose this. Your insurance company.

I started specialising in financial planning for medical professionals in 2015 and almost immediately became aware of the number of doctors who receive mental health exclusions on their Income Protection. An insurance company will typically apply a mental health exclusion when an individual has been formally diagnosed with a mental health condition (i.e. Anxiety, Depression, ADHD, Chronic burnout, etc.), or has received ongoing treatment/medication for such a condition.

As a popular option for insurance amongst doctors – PPS’s statistics can fill in some of the blanks here as to why this may be the case. Over the past 5 years, 20% of my clients have received an exclusion for mental health-related conditions on their Income Protection, due to this being a ‘pre-existing condition’ as defined by the insurance company. This is much, much higher than any other profession in my practice.

Furthermore, apart from 1 in 5 doctors receiving a mental health exclusion, out of the other 4 around 6% will be booked off from work for longer than 7 days due to a mental health-related condition within their first 3 years of work. This is nowhere near comparable to any other industry as no other industry (amongst my client base at least) has even reached 2% in this regard. Admittedly, this statistic has significantly increased over the past two years due to the effects of COVID on the public health sector.

What is the implication of this all?

If an insurance company determines that on average 6% of a certain profession claims for mental health-related conditions, within the first three years after obtaining Income Protection, they will naturally tighten the terms by which they apply mental health exclusions. Thus, doctors with the slightest history of mental health-related conditions, or even a brief period of counselling, will be subject to such exclusions and will be unable to claim for mental health-related conditions. This is likely what has already occurred, hence the 20% exclusion ratio already applicable to doctors.

In essence – because of the scale of mental health-related conditions amongst doctors, they are being denied the opportunity to claim from their Income Protection for these conditions. This is completely counterintuitive, as not being assured of your income during a period for which you’ve been booked off from work due to burnout, depression or any other mental health-related condition, can further fuel the initial condition. Unlike other professions where paid sick leave cover employees’ full salaries, doctors’ salaries consist of around 60% basic and 40% compulsory overtime – the latter being automatically forfeited when the doctor is booked off from work, resulting in an immediate financial loss.

What can we do about this?

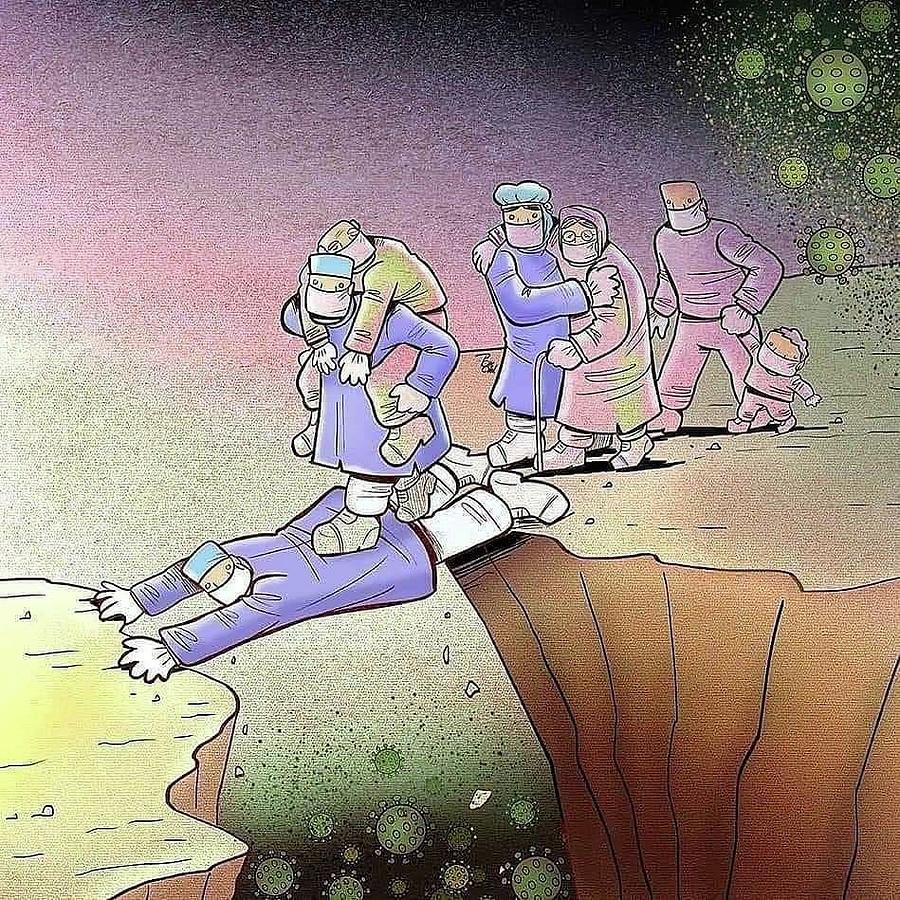

Like most things, first and foremost awareness is key. Society often mistakenly perceives doctors as unbreakable super-humans who can work face-to-face with death for 26 hours non-stop and then slot right back in with the rest of us speaking about politics, weather, and traffic around the dinner table. People (doctors included) should be made aware of the mental health crises unfolding in our healthcare system and put self-monitoring measures in place to keep a watchful eye on each other and their loved ones in the industry.

The next step would be to start working on preventative measures. When Discovery launched Vitality, they truly changed the behaviour of their clients, making them physically healthier. They incorporated technology to monitor fitness and started preventing countless heart and poor health-related conditions. This was beneficial to clients, as well as Discovery as they reduced medical aid and insurance claims. This is the level of innovation that insurance companies need to show towards the mental health crisis in the medical industry. Simply excluding these conditions from insurance is working in the opposite direction.

As a financial advisor, I’ve had a front-row seat to the economic impact that COVID has had, and continues to have on our country. It’s been said countless times that COVID broke our economy which was already crippled by unemployment and corruption. However, as an advisor for medical professionals, I’ve seen how COVID broke doctors who were already crippled by a system that didn’t support them. This all during a time when they are needed the most.

Ruan Stander (CFP®)

ruan@constans.co.za

www.constans.co.za